UAE Steel Market Overview

UAE Steel Market Overview

Blog Article

1. UAE Overview

United A rab Emirates (Arabic: امارات عربية متحدة), abbreviated as the United Arab Emirates, total area 83,600 square kilometers, the coastline is 734 kilometers long. As of July 2024, the total population of the UAE was 10.24 million, and the per capita GDP exceeded $50,000.

The UAE is a member of the Organization of Petroleum Exporting Countries (OPEC), with its national economy mainly focused on oil production and petrochemical industry. In addition, it has vigorously developed a knowledge economy with information technology as its core, while focusing on renewable energy research and development. The capital Abu Dhabi was selected as the headquarters of the International Renewable Energy Agency in June 2009. The UAE is also a member of the League of Arab States, the Gulf Cooperation Commission, and the Greater Arab Free Trade Area. The UAE has a lot of oil and gas resources. Proven oil reserves are about15 billion tons and natural gas reserves are 7.7 trillion cubic meters, ranking sixth in the world.

2. UAE's core steel enterprises

(1) Emirates Steel Arkan: The largest listed steel company in the UAE, mainly engaged in construction steel (reinforced bars, profiles, etc.), with an annual production capacity of over 3 million tons. In recent years, due to the impact of low-priced steel in China, ESA is negotiating with the government to restrict import policies to protect the local market. Its businesses cover steel smelting, building materials production and clean energy cooperation. In 2024, it will cooperate with UAE clean energy giant Masdar to put into production of the Green Hydrogen Steel Pilot Project to promote low-carbon steelmaking technology.

(2) AGSI:Arabian Gulf Steel Industries LLC, the largest steel recycling company in the UAE, is a company focused on steel recycling with annual production capacity.600,000 tons of steel bars, 100% of the steel scrap used comes from China.

(3) Dana Steel: Focusing on flat materials production, it announced an investment of 300 million Ah (about 82 million US dollars) in 2025 to build a new factory in Saudi Arabia, and plans to start production in mid-2025 to further expand the Middle East market share. DANA Group is installing a 400,000-ton/year cold rolled line in Dubai Industrial City to ensure the supply of raw materials for its coated steel plate production. It will increase the UAE cold-rolled coil capacity from the current 660,000 tons/year to 1.06 million tons/year.

(4) Al Gharbia Steel Pipe Company: Located in Khalifa Industrial Zone, Abu Dhabi (A factory of KIZAD plans to add 160,000 tons/year to expand the welded pipe capacity to 400,000 tons/year. Al Gharbia Steel Pipe Company has a 240,000 tons/year straight seam submerged arc welded pipe rolling mill with a maximum wall thickness of 45 mm and a steel grade of up to X80, mainly used in offshore pipelines and onshore projects. Aj mal Steel Pipe Industry Corporation plans to increase its production capacity to 1.25 million tons/year, thanks to the new 900,000 tons/year production line, which mainly produces API steel pipes with a diameter of 0.5-20 inches. The company has signed a strategic agreement with the Khalifa Economic Zone (KEZAD) in Abu Dhabi, and will also build a large steel pipe factory in the future.

(5)Al Ghurair Iron & Steel LLC:The largest combined flat steel rolling and hot-dip galvanizing enterprise in the Gulf Cooperation Council region. This annual productionThe 500,000-ton factory is strategically located in the Industrial City of Abu Dhabi (ICAD) in Musafa, Abu Dhabi, mainly meets the needs of the construction, manufacturing and other non-automotive industries in the Middle East and North Africa. AGIS is a joint venture between the UAE Al Ghurair Group and Japan's New Nippon Railway Corporation.

3. Famous UAE steel suppliers and features

(1) Local leading enterprise: UAE Iron and Steel Company (Emirates Steel, the largest local steel producer in the UAE, accounts for about 60% of the country's production capacity and is also a leading comprehensive steel company in the Middle East. It covers hot-rolled coils, cold-rolled coils, galvanized plates, rebars, wires, profiles (I-shaped steel, H-shaped steel), etc., and provides steel processing services (cutting, molding). It adopts advanced blast furnace-converter technology, complies with international standards such as ISO 9001 and ISO 14001, and some products have passed the European and American standards such as ASTM and EN. Deeply participate in landmark projects such as the Burj Khalifa, the Louvre of Abu Dhabi, and the Dubai Expo venues, as well as local infrastructure (roads, ports, residences). The advantage is that it has strong localized services, and its logistics network covers major UAE ports (Jebe Ali Port, Abu Dhabi Khalifa Port), and supports regional exports (Saudi Arabia, Qatar, Oman, etc.).

(2) Al Ghurair Group: Al Ghurair Group, one of the oldest industrial groups in the UAE, covers steel, aluminum, cement, food, etc. SubsidiaryAl Ghurair Iron & Steel mainly produces rebar, wire, round steel and other construction steels, and is involved in steel trade and distribution. Relying on the group's resources, we provide integrated services of "production + trade + logistics", especially in small and medium-sized construction projects with flexible response.

(3) International steel giants in Azeromettal (ArcelorMittal UAE): The world's largest steel company, Acelomital, has a joint venture in Abu Dhabi (cooperating with the Abu Dhabi Sovereign Fund), mainly produces high-end plates (such as automotive steel and household appliance steel). It has strict technical standards and is suitable for industrial customers with high quality requirements. Tata Steel UAE: Through cooperation with local companies, it provides hot-rolled coils, cold-rolled coils and other products, focusing on exporting to the Middle East and Africa markets, with strong price competitiveness.

4. UAE steel market demand is strong

Emsteel Group (Emirates Steel Arkan), the largest steel and building materials company in the United Arab Emirates, is in line with theThe steel market is optimistic in 2025. According to Arabian Gulf Business Insight, Emsteel Group CEO Said Gumran Al Remessi said steel demand is expected to grow by 10% in 2025 thanks to billions of dollars in infrastructure and real estate projects in the UAE.

The UAE is currently conducting several large-scale infrastructure projects with a total value of US$772 billion, which is expected to bring ongoing steel demand, with 52% of projects still in the planning, design or tendering stages.

These projects include the $35 billion expansion of Dubai Maktoum International Airport, the Dubai Metro extension and the newly announced Disney theme park on Yas Island in Abu Dhabi. According to Emsteel's chief commercial officer Michael Lyon, an airport project alone requires 2 million tons of steel bars, and the subway extension line also requires 350,000 tons. In 2024, UAE steel demand has surged by 20%, showing strong market momentum. Steel demand is expected to grow by 10% in 2025, to meet the surge in demand.Emirates Steel, a subsidiary of Emsteel, has increased its monthly output from 260,000 tons to 400,000 tons, an increase of more than 50%.

The UAE construction market is expected to maintain strong growth momentum. According to Mordor Intelligence statistics, it is expectedThe UAE construction market size will reach US$40.88 billion in 2024 and will surge to US$51.8 billion by 2029, with a compound annual growth rate of about 4.9%.

The improvement of UAE residents' consumption level and the entry of many overseas automobile industries such as Mercedes-Benz, Toyota, and BYD have brought new growth momentum to the automobile market.From January to September 2024, UAE automobile market sales increased significantly by 12.0% year-on-year, indicating that the demand for hot-rolled coil market will be further released.

5. UAE Steel Major importing countries-China

The UAE imported steel products from China are centered on construction steel (the proportion is more than70%), mainly including: rebar accounts for 40%-50% of export volume, and is mainly used in real estate and infrastructure projects (such as residential and bridges). Wires account for 20%-25%, and are used for steel bar processing and small components. Plates (hot-rolled coiled plates, galvanized plates): accounting for 15%-20%, used in steel structures in industrial factories and venues.

In recent years, as the UAE transforms into high-end manufacturing industries (such as aviation and new energy),The export share of industrial steel (such as cold-rolled coil plates and stainless steel pipes) increased from 10% in 2014 to 25% in 2023, mainly supplied to Abu Dhabi Petroleum Corporation's refining and chemical projects and Dubai's high-end manufacturing industry.

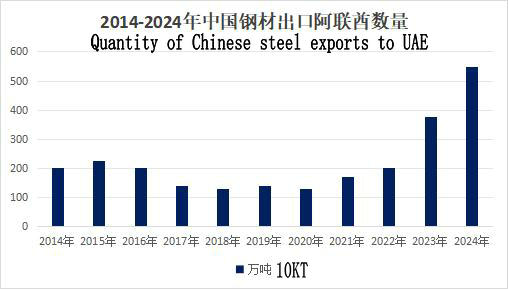

China's steel exports to the Middle East increased significantly in 2024, especially the UAE. In 2024, China exported 5.48 million tons of steel to the UAE, an increase of 46.1% from 3.78 million tons in 2023. The export growth rate is the second largest steel exporter in the world among China's steel exporters, and the UAE is China's third largest steel exporter. From January to April 2025, China exported 1.958 million tons of steel to the UAE, an increase of 13% year-on-year. The UAE continued to maintain its strong demand for Chinese steel.

Sinosteel Stainless Steel Pipe is the Manufacturer and Supplier of Stainless Steel Pipe and Special Alloy Pipe, Steel pipes with an outer diameter from 8mm to 3600mm, with wall thicknesses from 0.2mm to 120mm.